Regression analysis in business valuation, particularly the Direct Market Data Method (DMDM), relies on R-squared (R²) values. This article examines these statistical concepts, their interpretation and their implications for SBA 7(a) valuations.

The Role of R-Squared in Regression Analysis

R-squared (R²) measures the proportion of variance in the dependent variable (e.g., sale price) explained by independent variables (e.g., revenue). An R² near 1 indicates a strong linear relationship, while near 0 suggests weak explanatory power. In DMDM, high R² (e.g., > 0.85) indicates strong explanatory power, supporting reliable valuation multiples. Low R² suggests other factors drive value, requiring caution.

Common Misinterpretations of R-Squared

A low R² is often misinterpreted as invalidating a regression model. However, a low R² does not negate a valid linear relationship; it indicates limited explanatory power. Transaction data’s qualitative noise (e.g., buyer motivations) often yields low R², but the regression’s best-fit line remains statistically valid, though less predictive.

Why a Low R-Squared Doesn’t Invalidate a Linear Model

A scatterplot may reveal a linear trend despite low R², indicating a statistically valid model structure but weak reliability. Professionals must assess visual trends and data context, avoiding premature dismissal of regression analysis in DMDM applications.

When to Reject or De-Emphasize the Direct Market Data Method

DMDM should be rejected or de-emphasized when:

- R² is very low.

- Scatterplots show no linear trend.

Appraisers must document these issues. In DMDM, price to revenue multiples with R² > 0.85 are preferred, while SDE multiples are avoided due to subjectivity.

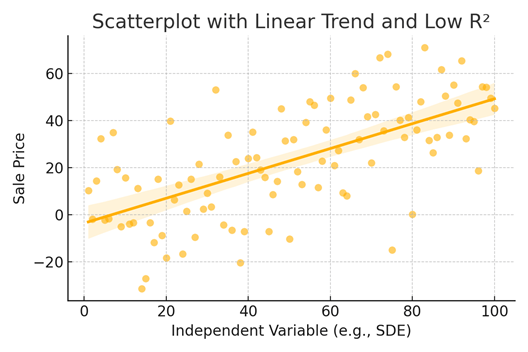

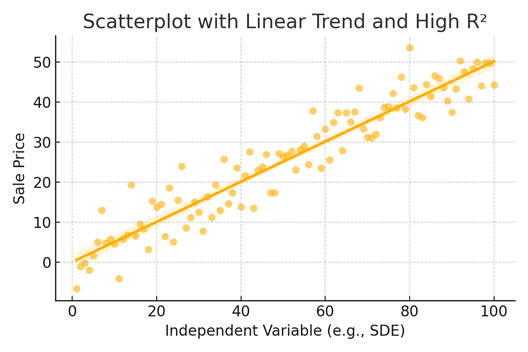

Visual Examples of Regression Interpretation

Figure 1: A scatterplot of sale price vs. revenue with R² = 0.3 shows a weak linear trend, indicating limited explanatory power but a valid model structure, urging caution in DMDM use.

Figure 2: A scatterplot with R² = 0.9 shows a strong linear trend, supporting reliable DMDM multiples for valuation.

Conclusion

R-squared is critical in assessing DMDM reliability for business valuations. Low R² values signal caution but don’t invalidate linear models. For SBA 7(a) loans, R² > 0.85 and price to revenue multiples ensure robust DMDM valuations. Transparent analysis, visual interpretation, and qualitative judgment yield credible valuations.